Possibility of Fuel Price Hike Before the Budget: What Does the JM Financial Report Say?

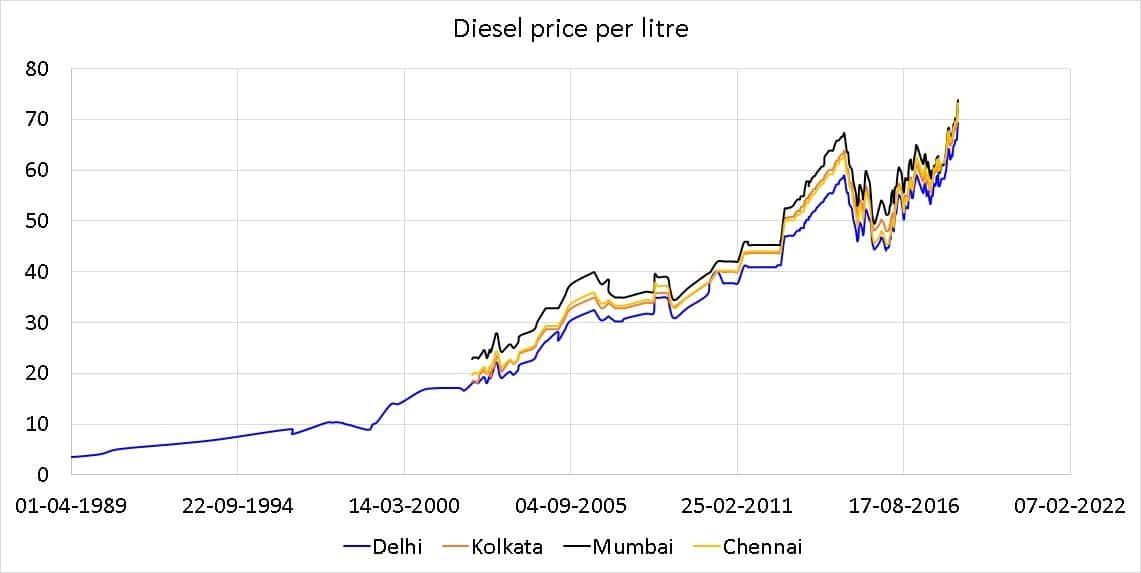

Mumbai: Petrol and diesel prices have remained stable for the past several months, but a change is now being predicted. According to a new report by brokerage firm JM Financial, the central government may increase the excise duty on petrol and diesel by Rs 3 to 4 per liter before the Union Budget is presented on February 1, 2026. This is likely to put an additional burden on the common man's pocket.

The report states that oil marketing companies (OMCs) are currently making significant profits. The current price of Brent crude oil is around $61 per barrel, which is lower than the normal level. This has resulted in high gross marketing margins (GMM) of Rs 10.6 per liter and integrated gross margins of Rs 19.2, which are higher than the historical average. On the other hand, the central government is facing increasing fiscal pressure. Revenue collection in the financial year 2026 has lagged behind the budgetary estimates ΓÇô it was only 56% between April and November 2025, compared to 60% during the same period last year. The pace of tax collection has also slowed down.

This increase in excise duty could provide the government with an additional revenue of Rs 50,000 to 70,000 crore annually. An increase of Re 1 per liter would yield approximately Rs 17,000 crore. However, this could impact the profits of oil companies. JM Financial has maintained a 'Sell' rating on HPCL and a 'Reduce' rating on IOCL and BPCL. The report states that the current high margins will not last long and investors should exercise caution.

The government's fiscal deficit target is 4.4%, and GDP growth is expected to be 8%, yet this remains challenging. Against this backdrop, increasing fuel taxes could be an easy option for the government. It is necessary to keep a close watch on fuel prices in the coming days.

Mumbai: Petrol and diesel prices have remained stable for the past several months, but a change is now being predicted. According to a new report by brokerage firm JM Financial, the central government may increase the excise duty on petrol and diesel by Rs 3 to 4 per liter before the Union Budget is presented on February 1, 2026. This is likely to put an additional burden on the common man's pocket.

The report states that oil marketing companies (OMCs) are currently making significant profits. The current price of Brent crude oil is around $61 per barrel, which is lower than the normal level. This has resulted in high gross marketing margins (GMM) of Rs 10.6 per liter and integrated gross margins of Rs 19.2, which are higher than the historical average. On the other hand, the central government is facing increasing fiscal pressure. Revenue collection in the financial year 2026 has lagged behind the budgetary estimates ΓÇô it was only 56% between April and November 2025, compared to 60% during the same period last year. The pace of tax collection has also slowed down.

This increase in excise duty could provide the government with an additional revenue of Rs 50,000 to 70,000 crore annually. An increase of Re 1 per liter would yield approximately Rs 17,000 crore. However, this could impact the profits of oil companies. JM Financial has maintained a 'Sell' rating on HPCL and a 'Reduce' rating on IOCL and BPCL. The report states that the current high margins will not last long and investors should exercise caution.

The government's fiscal deficit target is 4.4%, and GDP growth is expected to be 8%, yet this remains challenging. Against this backdrop, increasing fuel taxes could be an easy option for the government. It is necessary to keep a close watch on fuel prices in the coming days.

The report states that oil marketing companies (OMCs) are currently making significant profits. The current price of Brent crude oil is around $61 per barrel, which is lower than the normal level. This has resulted in high gross marketing margins (GMM) of Rs 10.6 per liter and integrated gross margins of Rs 19.2, which are higher than the historical average. On the other hand, the central government is facing increasing fiscal pressure. Revenue collection in the financial year 2026 has lagged behind the budgetary estimates ΓÇô it was only 56% between April and November 2025, compared to 60% during the same period last year. The pace of tax collection has also slowed down.

This increase in excise duty could provide the government with an additional revenue of Rs 50,000 to 70,000 crore annually. An increase of Re 1 per liter would yield approximately Rs 17,000 crore. However, this could impact the profits of oil companies. JM Financial has maintained a 'Sell' rating on HPCL and a 'Reduce' rating on IOCL and BPCL. The report states that the current high margins will not last long and investors should exercise caution.

The government's fiscal deficit target is 4.4%, and GDP growth is expected to be 8%, yet this remains challenging. Against this backdrop, increasing fuel taxes could be an easy option for the government. It is necessary to keep a close watch on fuel prices in the coming days.

.jpg)